(NEW YORK) — Stock prices worldwide seesawed dramatically this week, forcing investors to keep up with sudden turns in the market and weather fears of an economic slowdown.

The S&P 500 on Monday suffered its worst decline in a single trading day since 2022. In early trading on Tuesday, the index recovered more than half of those losses.

Japan’s main Nikkei 225 stock index on Monday dropped more than 12%, its worst trading session since 1987. On Tuesday, the index soared 10%.

Market analysts who spoke to ABC News urged investors to be patient despite pressure to either join a selloff or buy a downturn. The market typically experiences temporary periods of decline, they added, noting the strong performance for stocks this year prior to the recent losses.

Broad losses may offer investors an opportunity to buy low on a high-quality stock that they’d been eyeing anyway, some analysts said, but they advised seeking out stocks viewed as long-term investments.

“I wouldn’t be panicking in this environment,” Ed Yardeni, the president of market advisory firm Yardeni Research and former chief investment strategist at Deutsche Bank’s U.S. equities division, told ABC News. “It could be a roller-coaster ride.”

Recession fears and the unwinding of a ‘carry trade’ in Japan

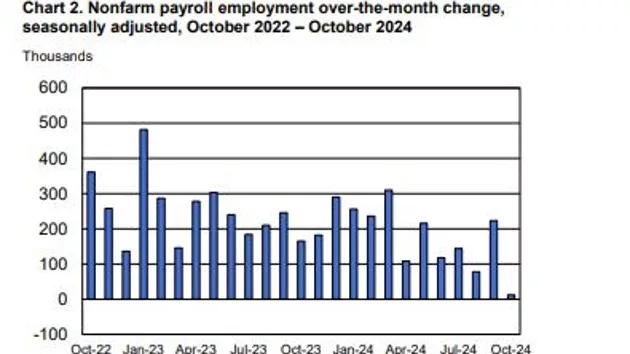

The stock market downswing was set off by a disappointing jobs report on Friday. Employers hired 114,000 workers in July, falling well short of economist expectations of 185,000 jobs. The unemployment rate climbed to 4.3%, the highest level since October 2021.

The lackluster jobs data fueled concern about a potential recession and calls for an interest rate cut.

The heightened worry about an economic cooldown coincided with interest rate hikes imposed by Japan’s central bank. Those rising rates prompted an unwinding of a so-called “carry trade” in which investors borrowed Japanese yen at low interest rates and used it to purchase assets, including U.S. stocks.

When Japan hiked rates, investors sold off some of those assets and sent stock prices falling.

“There are a lot of things that have happened here in the past three business days. There are a lot of headlines flying around,” Bret Kenwell, an investing analyst at eToro, told ABC News. “It’s important for investors to remember the long-term trends in the market. They should have a lot of caution.”

Between 1980 and 2023, the S&P 500 posted a positive return over the calendar year 82% of the time, Wells Fargo Investment Institute told clients in a note on Tuesday. The market experienced a drop-off of at least 10% in nearly half of those years, Wells Fargo said, adding, “The data shows that a market downturn does not necessarily mean markets will perform poorly for the year.”

Market analysts advised caution as investors weigh opportunities to take advantage of the volatility. Still, they added, some traders may find a chance to obtain stocks that were previously too expensive.

Dan Ives, a managing director of equity research at investment firm Wedbush, said the tumult roiling markets offers investors an entryway into major tech stocks at discounted prices.

“It’s a white-knuckle moment that we view more as an opportunity to own big tech and the AI revolution, which is not going away,” Ives told ABC News.

Nvidia, a chipmaker that had helped catapult market gains so far this year, dropped as much as 14% on Monday before recovering some of those losses. The stock climbed nearly 5% in early trading on Tuesday.

Shares of Apple fell as much as 10% on Monday, in part because Berkshire Hathaway CEO Warren Buffett sold half of his holdings in the company. Apple recovered some of those losses by the close of markets but inched downward in early trading on Tuesday.

“Any global jitters and fears of market turmoil are going to be an overhang for tech stocks,” Ives said. “We stay calm and focused on the tech winners.”

Kenwell said investors should calmly evaluate their asset allocation, risk tolerance and long-term goals.

“When volatility is spiking and markets are selling off, it’s really easy to open your portfolio and panic,” Kenwell said.

“Follow your long-term plan,” he added. “That’s why it’s there.”

Copyright © 2024, ABC Audio. All rights reserved.