When you’re struggling with a mountain of credit card debt, it’s easy to fall victim to phony debt relief companies that promise a quick and easy solution – guaranteed.

These bogus outfits typically tell you to stop making payments to your creditors. That’s a bad idea for numerous reasons.

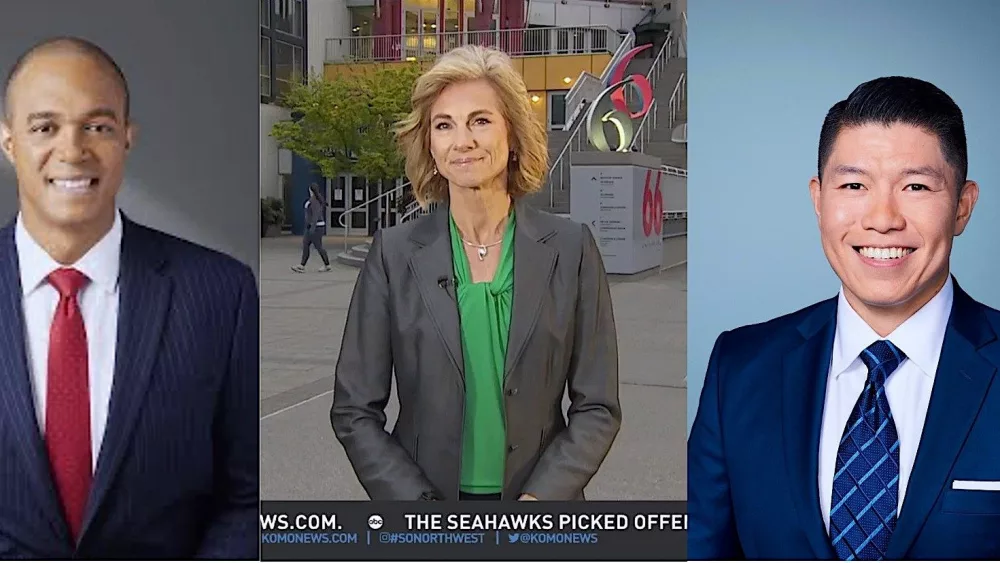

“If you stop making payments to your credit card company, what do you think is going to happen? It’s only going to make things worse,” said Bruce McClary, a vice president with the National Foundation for Credit Counseling. “Your creditor could come back and sue you for the amount of money that you owe. So, it’s a very risky proposition.”

A non-profit credit counselor can get you back on track. Cara, who lives in Boston and asked us not to use her last name, had nearly $60,000 in credit card debt. Her non-profit credit counselor got her credit card rates lowered, and set up a five-year payment plan. Today, Cara is debt free, and her credit score has jumped 100 points.

“My advice is to just call and reach out for help and do it, because no one’s going to yell at you. No one’s going to be judgmental,” Cara told me. “The counselor that I met with was just really friendly and like I said, non-judgmental. That was my biggest concern, that I was going to be embarrassed. I wasn’t embarrassed. They talk you through it.”

You can find a non-profit credit counselor by going to the National Foundation for Credit Counseling website, NFCC.org, or call 800-388-2227.

More Info: Dealing with Debt: The Smart Way to Get Your Finances Back in Order

(This story includes the Consumerpedia podcast: Dealing with Debt in which Cara shares her story and McClary talks more about how credit counseling works.)